The U.S. SaaS market has never been more crowded or competitive. Between NASDAQ-listed giants expanding aggressively and emerging players in tech hubs like Silicon Valley, Austin, Boston, and Seattle, the race to capture attention and decision-maker trust has intensified. Sales teams targeting U.S.-based companies face mounting pressure, not just to generate leads but to close quality deals faster.

Yet, 77% of B2B buyers in the U.S. are involved in group-based purchase decisions, making outreach more complex. This is exactly where ABM org charts, maps of influence and decision pathways inside U.S. accounts powered with GenAI-driven data, become a competitive advantage.

Let’s explore the key challenges faced when targeting U.S. SaaS companies and how an ABM strategy using actionable org charts combined with GenAI can transform lead generation, deal closing, and retention in this landscape.

You’re losing traction with top U.S. accounts. What gaps are holding you back?

Many teams targeting US-based SaaS industry face a trio of challenges:

- Market density and noise: With over 17,000 SaaS vendors in the U.S. alone, standing out is increasingly difficult.

- Difficulty reaching decision-makers: The listed contact is rarely the true budget approver or technical evaluator.

- Low conversion and long cycles: Even when leads enter the funnel, many stall because multiple U.S.-based stakeholders aren’t engaged in sequence.

These issues drain resources and distort pipeline forecasts, particularly when competing in U.S. innovation hubs where attention spans are short, and competition is fierce.

Could misalignment between outreach and reality be holding your U.S. campaigns back?

In U.S. SaaS firms listed on NASDAQ, personalization is no longer optional, instead it's a revenue lever. Yet 60% of marketers admit they still struggle to generate quality leads, often because their outreach is too broad. Traditional CRM systems show contacts, but without contextual org views, teams miss how those contacts interconnect across departments.

ABM org charts bridge this gap by mapping hierarchical and cross-functional relationships within target U.S. accounts, giving your strategy laser precision. When paired with GenAI, these charts evolve into a predictive engine. They identify patterns in decision paths, suggest optimal engagement sequences, and highlight hidden influencers who can accelerate your US deal movement.

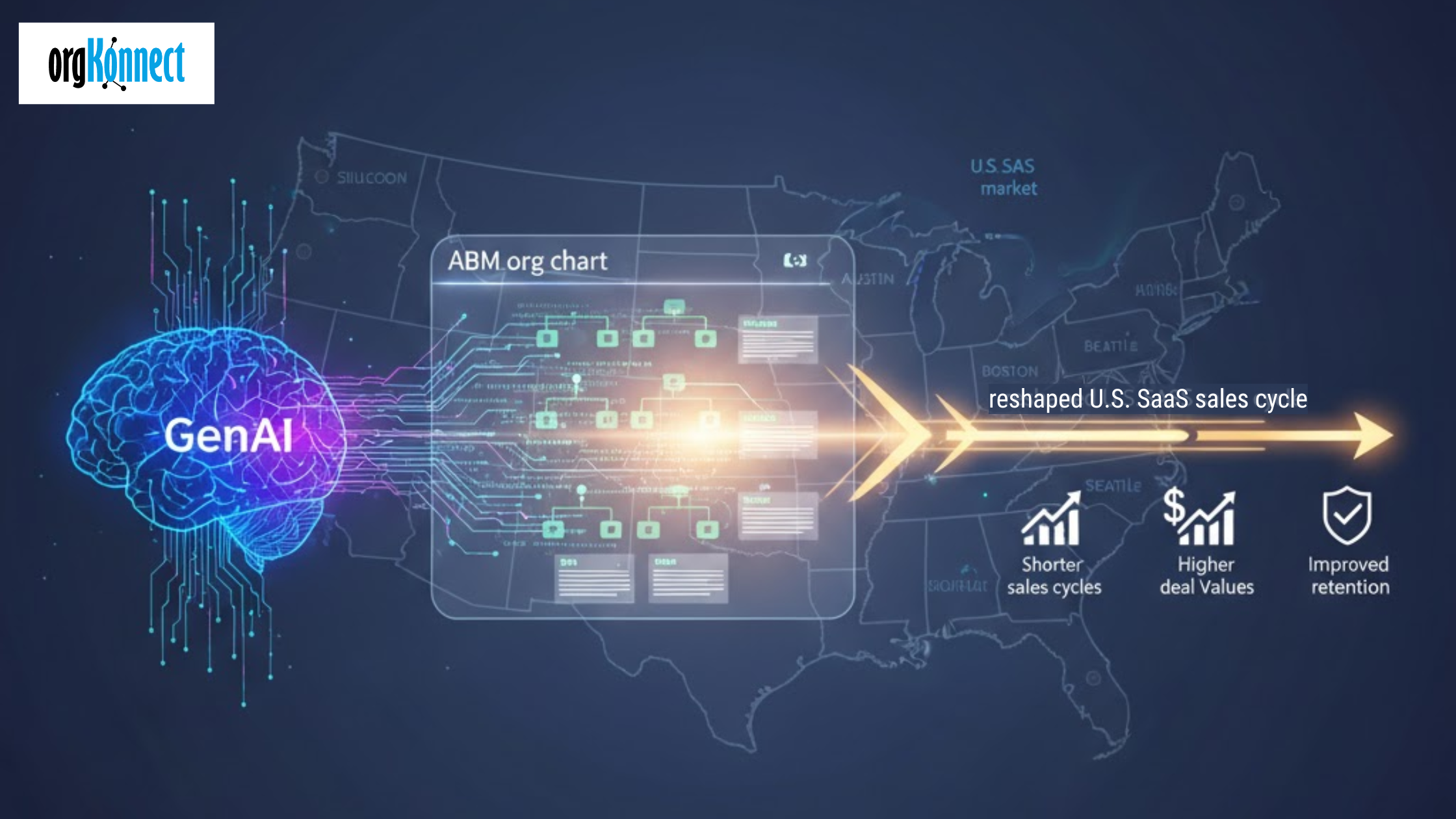

Is the GenAI-ABM combination reshaping U.S. SaaS sales cycles?

Absolutely. Integrating GenAI with ABM org charts enables teams targeting U.S. companies to analyze corporate structures, uncover hidden power centers, and personalize content for each stakeholder. AI’s predictive layer tells you not just who to connect with but also when and how to engage each decision-maker most effectively.

This synergy improves targeting in U.S. B2B SaaS markets and delivers measurable outcomes:

- Shorter sales cycles: Predictive routing identifies responsive decision-makers faster.

- Higher ROI: Precision targeting reduces wasted ad spend and irrelevant outreach.

- Higher deal values: Multi-threaded engagement nurtures larger, cross-functional contracts.

- Improved retention: GenAI surfaces post-deal engagement opportunities by identifying client expansion paths.

Could ABM org charts define the next era of growth for teams targeting U.S. SaaS companies?

For sales and marketing teams aiming at U.S.-based SaaS companies, access to accurate, actionable enterprise data is a critical differentiator. The U.S. Chamber of Commerce emphasizes that SaaS is one of the fastest-evolving B2B categories globally, and success depends on understanding decision-making networks within target accounts. ABM org charts provide that visibility, helping teams identify key stakeholders, map influence pathways, and coordinate outreach effectively.

Whether your campaigns focus on startups in Austin, mid-market firms in Seattle, or established players in Boston’s innovation corridor, ABM org charts act as a central intelligence hub. When enriched with GenAI insights, these charts enable teams targeting U.S. companies to:

- Pinpoint decision-makers at the right moment in the buying process.

- Predict potential churn risks or obstacles before they arise.

- Tailor engagement strategies to each stakeholder, improving conversions and long-term retention.

By giving revenue teams a clear, data-driven view of their U.S. target accounts, ABM org charts transform scattered leads into structured opportunities and ensure that every interaction is strategic and impactful.

Let’s address the key FAQs that teams targeting U.S.-based SaaS industry often ask

Q1. How do ABM org charts help marketers target U.S. B2B SaaS companies?

They visualize key decision-makers within complex accounts, enabling precise outreach, higher-quality leads, and better conversions.

Q2. Why is the U.S. a hotspot for ABM innovation?

With over 17,000 SaaS vendors competing nationally, ABM org charts allow marketers to target multiple stakeholders effectively in crowded markets.

Q3. How do ABM org charts improve retention in the U.S.-based SaaS firms?

They identify internal champions in renewal accounts, reducing churn and boosting upsell opportunities.

Q4. Are ABM org charts effective for targeting all U.S. regions?

Yes, whether in Silicon Valley, Boston, Seattle, or Austin, org charts help teams navigate local market complexities and decision-making hierarchies.

CLICK HERE to find the right door-opener faster with BizKonnect.