The final quarter of the year is when automotive business leaders conduct a crucial audit, tallying the successes and more importantly, diagnosing the lost opportunities that will inform their strategy for the coming year.

As we finalize our strategic blueprints for 2026, a critical question emerges: did your team truly engage with the right decision-makers within the automotive giants this past year?

Many sales organizations still operate with static contact data, treating major Original Equipment Manufacturers (OEMs) as single, monolithic accounts. This approach is rapidly becoming obsolete because of the complexity of these corporations. They are now driven by massive transitions in electrification and software, demanding a shift in outreach perspective.

That’s where dynamic, GenAI-driven auto company org charts enable you to map out the true landscape of influence and build an effective outreach strategy for successful prospecting.

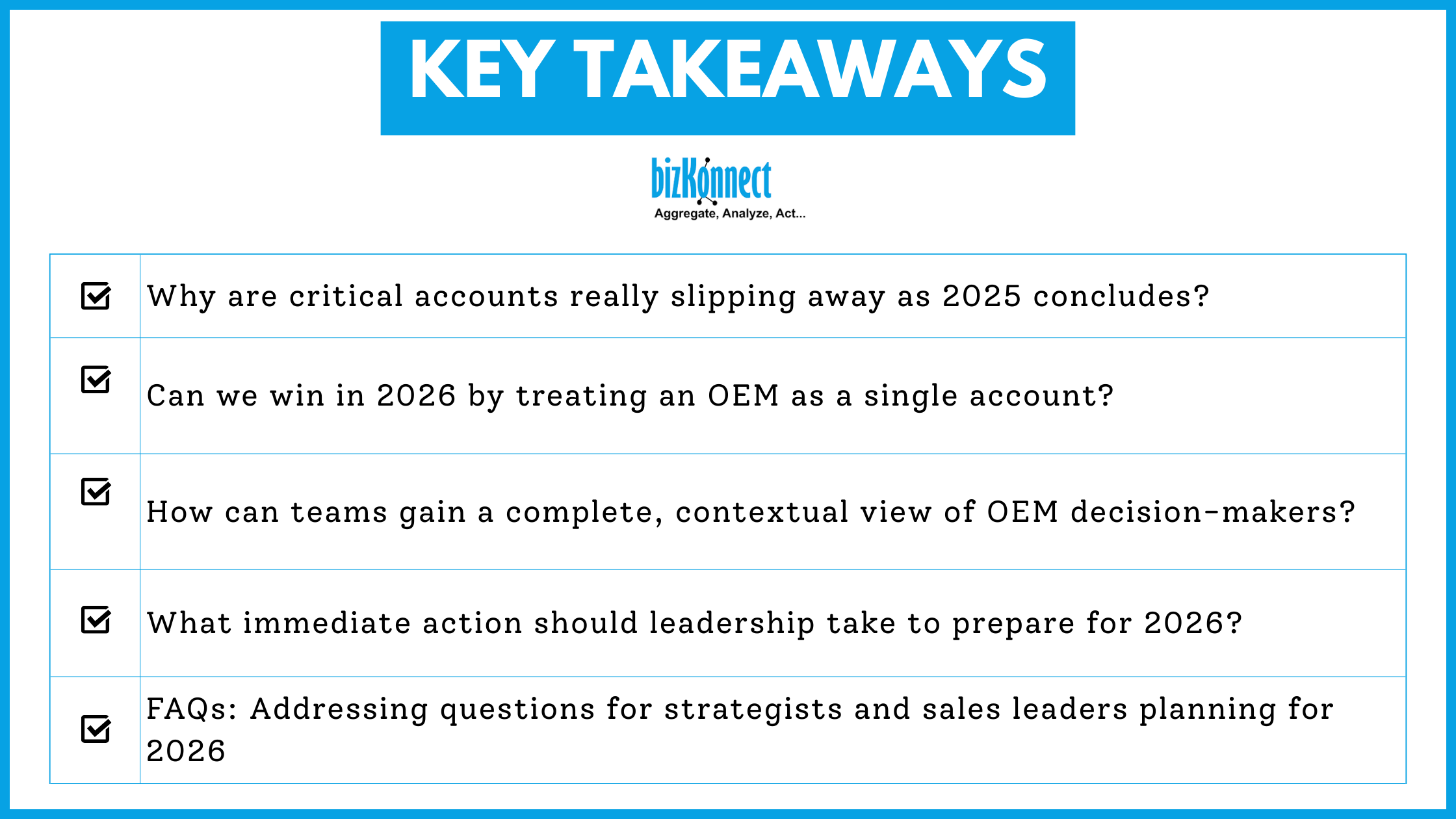

Why are critical accounts really slipping away as 2025 concludes?

The root cause of lost OEM deals often lies in a superficial understanding of the buyer's internal network, leading to poor execution. December introspection frequently reveals the same three patterns among underperforming accounts:

- Wrong Contact, Late Discovery: Starting an engagement with the wrong initial contact and discovering a crucial technical buyer or key influencer too late in the cycle to pivot effectively.

- Siloed Outreach: Marketing, Sales, and Inside Sales operate from different, incomplete, or outdated data sets, leading to fragmented, irrelevant, or repetitive communications.

- Static Data Reliance: Relying on a fixed organizational structure of automotive companies that fails to capture the reality of modern, cross-functional purchasing teams.

This challenge is magnified when dealing with technology sales, where legacy views of the automotive company organizational structure cannot keep pace with the hyper-accelerated shift in priorities.

Can we win in 2026 by treating an OEM as a single account?

Absolutely not. Treating major OEMs as simple, fixed accounts will guarantee lost business in 2026.

The automotive industry is rapidly transforming into a software-driven future. The global automotive software market, for example, is projected to reach over $66.18 billion by 2030 with a Compound Annual Growth Rate (CAGR) of 15% from 2025, demonstrating where the investment and decision-making power is moving. OEMs are no longer just manufacturers; they are vast, interconnected ecosystem networks.

Winning requires understanding these ecosystem flows. For instance, successfully navigating the organization of a company like BMW or General Motors means recognizing the distinct power centers:

- Software-Defined Vehicle (SDV) Units: Dedicated entirely to in-car operating systems and connected services (e.g., GM’s Ultifi, VW’s Cariad, Toyota Woven).

- Electrification (EV) & Battery Units: The core drivers of future production and technology (e.g., Ford’s Model e, BMW’s ongoing transition to e-mobility).

- Advanced Driver-Assistance Systems (ADAS) Groups: Focused on autonomy and safety features.

- Next-Gen Manufacturing: Entirely new smart factory divisions focused on digitization and efficiency (e.g., BMW’s iFactory).

A paper automotive industry org chart doesn't show the flow of budget or influence between a manufacturing unit and an SDV team. Understanding this dynamic environment is the only way to identify the champion nodes where technology decisions are truly incubated and signed off.

How can teams gain a complete, contextual view of OEM decision-makers?

The key lies in leveraging intelligence platforms that move beyond simple hierarchies to provide contextual account maps tailored to your specific solution. Instead of a high-level org chart of auto companies, successful teams in 2026 will rely on GenAI-driven auto company org charts, enriched with up-to-date contact information of key stakeholders.

This dynamic intelligence is vital because it allows commercial teams to:

- Deeply Understand Structure: Instantly access and analyze intricate hierarchies, reporting lines, and the function of various departments, which is crucial when comparing, for example, the Tesla auto company org chart 2025 to a more established automotive company.

- Personalize Strategy: Craft targeted, relevant messages that resonate with a specific ecosystem unit, such as an EV battery procurement team or an ADAS software development group.

- Track Opportunities: Utilize the organization map as a comprehensive tracking system, ensuring no opportunity or stakeholder movement goes unnoticed.

What immediate action should leadership take to prepare for 2026?

Leadership must recognize that data fragmentation is the enemy of cohesive, high-value engagement. The primary strategic alignment for the new year is unifying the commercial front. Encourage your Sales, Marketing, and Inside Sales teams to align and work from a single source of truth with the dynamic GenAI-driven auto company org charts.

This shared, comprehensive view ensures that lead generation efforts map directly to sales strategy and that everyone targets the same high-value departments and decision-makers. It’s the difference between merely mapping an account and strategically navigating an ecosystem, fundamentally changing the answer to “How do automotive companies organize their departments?” for your entire commercial organization.

FAQs: Addressing questions for strategists and sales leaders planning for 2026

1. What specifically defines an OEM as an "ecosystem" rather than a traditional "account"?

An OEM ecosystem is defined by internal and external networks of business units such as EV, SDV, battery, and ADAS. It operates with distinct budgets, decision-makers, and technical requirements, often cross-pollinating influence across traditional departmental silos.

2. In 2026, which internal OEM groups (e.g., EV, Software, Manufacturing) are typically the "champion nodes" for new technology decisions?

While this varies by specific solution, "champion nodes" are increasingly found within the SDV, ADAS, and specific manufacturing digitization (e.g., smart factory) units, as these areas represent the primary vectors for future OEM revenue growth and transformation.

3. Will a high-level organizational structure of automotive companies suffice for a new vendor entering the market in 2026?

No. New vendors require a detailed org chart of auto manufacturing companies and deep insights into the "champion nodes" to avoid wasting time on non-decision-makers. The market is too competitive for generalized outreach.

Find the right door-opener faster within OEM giants. CLICK HERE to see how GenAI-powered actionable org maps do it with BizKonnect.