JP Morgan

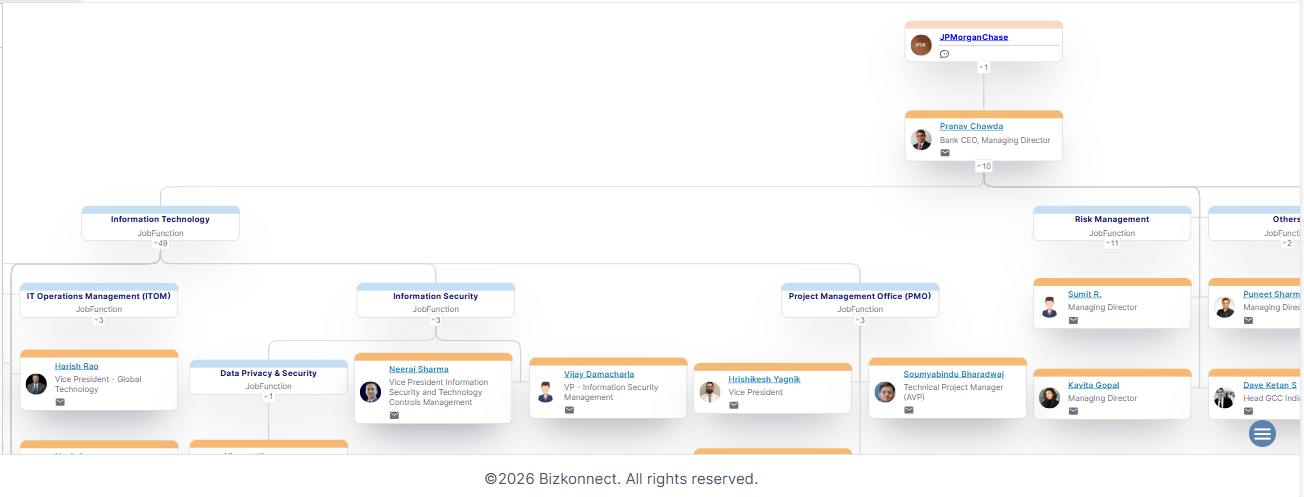

JPMorgan Chase Organizational Chart - JPMorgan Chase USA is a global financial services powerhouse with a sophisticated organizational structure. It connects executive leadership to business divisions spanning consumer banking, commercial banking, investment banking, asset management, and payments processing. The company reported revenue of $158.1 billion in 2023, with net income of $49.6 billion, serving millions of customers through approximately 4,700 branches across over 100 countries worldwide.

Company Overview - JPMorgan Chase USA, headquartered in New York City, is the largest bank in the United States and one of the world's most prominent financial institutions. Its operations include Chase consumer and business banking, JPMorgan wealth management, corporate and investment banking, commercial banking, asset management, and merchant services. The company provides credit cards, mortgages, loans, investment services, treasury services, and advisory services for mergers and acquisitions, while investing in digital banking platforms, fintech innovation, cybersecurity, and AI for risk management.

FAQs -

1. What is the JPMorgan Chase Org Chart?

The chart breaks down JPMorgan into business lines: Consumer Banking, Corporate & Investment Bank, Commercial Banking, Asset Management, and corporate functions like tech and risk.

2. How often does the JPMorgan Chase Org Chart get updated?

Updates align with annual reviews, regulatory changes, or major acquisitions, typically once or twice yearly.

3. Why is the Org Chart of JPMorgan Chase important for B2B outreach?

Fintech vendors must distinguish between retail banking tech needs versus investment banking infrastructure or wealth management platforms.

4. Which functions are most relevant in the JPMorgan Chase Org Chart for vendors?

Technology infrastructure, cybersecurity, risk management, digital banking, and payment processing teams are high-priority contacts.

5. How can marketers use the JPMorgan Chase Org Chart effectively?

Segmenting outreach by business units like targeting fraud detection tools to consumer banking versus trading platforms to the investment bank improves relevance and conversion.